The Federal Reserve still has the ability to put the brakes on any hyperinflation or any further worsening of the economy.

Many of the proposed solutions to this issue will improve the situation now, but create larger problems in the future. However, there are some things that the Federal Reserve can do that will improve the current situation without mortgaging the future to do so.

As I wrote in my previous article, the Federal Reserve requires that banks maintain 10% of all checking deposits on hand. For savings accounts, the reserve requirement is essentially zero (I say essentially because the Federal Reserve requires than banks hold a very small amount of money on hand in order to clear small overnight transactions, but when compared to the trillions of dollars held in savings accounts, this requirement is essentially zero).

Is this reserve requirement too high, too low, or what?

To answer this question, we must first take a brief look at some of the important features of our monetary system [although the information below seems like a lot, I must assure you that it is brief and that numerous books have been written on the subject]. The information below can be found in many sources and I will be happy to provide them for you like.

Money is a medium of exchange. We all know that exchange is necessary in just about every economy, and especially in one as large and developed as ours. Without trade, each person would have to be self sufficient–they would have to grow their own food, make their own shoes and clothing, build their own houses, brew their own beer, and so on.

Trade allows each person to work in the field in which they have the greatest “comparative advantage,” when compared with others. This simply means that people will choose to do the job that they are best at when compared to others. For example, if I can grow 5000 pounds of wheat per day or work as a receptionist and answer 20 calls per day, while you could grow 1000 pounds of wheat per day or work as a receptionist and answer only 10 calls per day, I should seek employment as a wheat farmer and you should seek employment as a receptionist. I might be better at both jobs that you are, but I have the “comparative advantage” in farming and thus should be a farmer.

In an economy with only two goods, exchange is easy–“I will grow wheat for you if you will answer my phones,” but as the economy expands this becomes harder to do. It becomes difficult to make exchanges with someone in a barter economy if both parties do not have the goods that the other party wants. As economist Walter Block explains the situation [page 200]:

“Consider the plight of the person who has in his possession a barrel of pickles which he would like to trade for a chicken. He must find someone who has a chicken and would like to trade it for a barrel of pickles. Imagine how rare a coincidence would have to occur for the desires of each of these people to be met. Such a “double coincidence of wants” is so rare, in fact, that both people would naturally gravitate toward an intermediary, if one were available. For example, the chicken-wanting pickle owner could trade his wares to the middleman for a more marketable commodity (gold) and then use the gold to buy a chicken. If he did, it would no longer be necessary for him to find a chicken-owning pickle wanter. Any chicken owner will do, whether he wants pickles or not. Obviously, the trade is vastly simplified by the advent of the middleman. He makes a double coincidence of wants unnecessary.”

If the government doesnt outlaw competing currencies, competition takes place over which good will be used as the “medium of exchange” until one or a few goods wins out and becomes widely accepted and used. This material serves the same role as a middle man, it connects potential buyers and sellers in an efficient manner and facilitates trade. Historically, from the time of the ancients to the Greeks and Romans, to the later Europeans, to the Chinese, Aztecs, Mayans, and so on, gold and silver have won out and been widely used as currencies.

Originally, banks were little more than storage facilities. After all, if gold or silver is used in every transaction, it probably isnt smart to have all of your gold and silver lying around your house (especially back in the days before alarm systems). People would bring their gold or silver to banks and would receive a receipt detailing the measure of either gold or silver, and often a description of the quality (ie, the receipt would read: 1 oz, 18KT Gold). Over time, the receipts from the more reputable deposit facilities began to be used in everyday transactions. If I held a receipt from a well known bank that promised the holder 1 oz of gold and I needed to purchase a product that cost the equivalent of 1 oz of gold, I might be able to convince the seller of the product to accept my receipt instead of making me go to the bank.

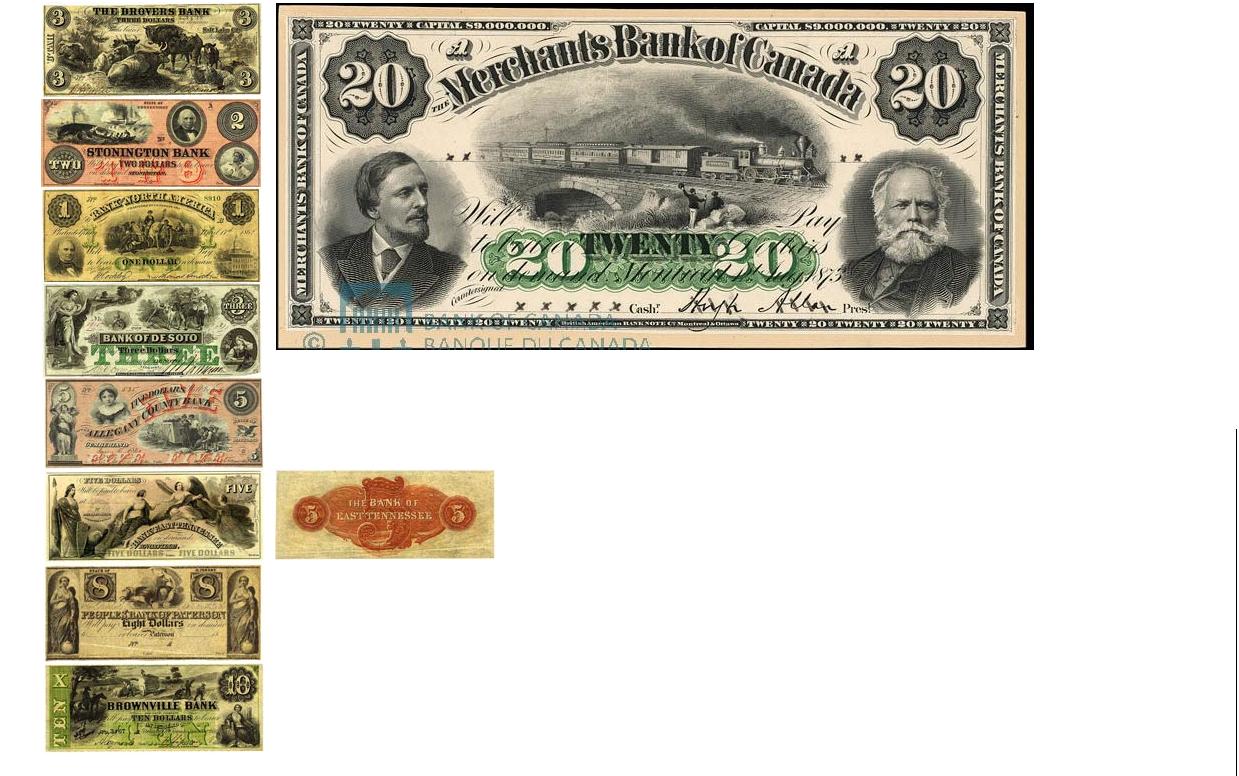

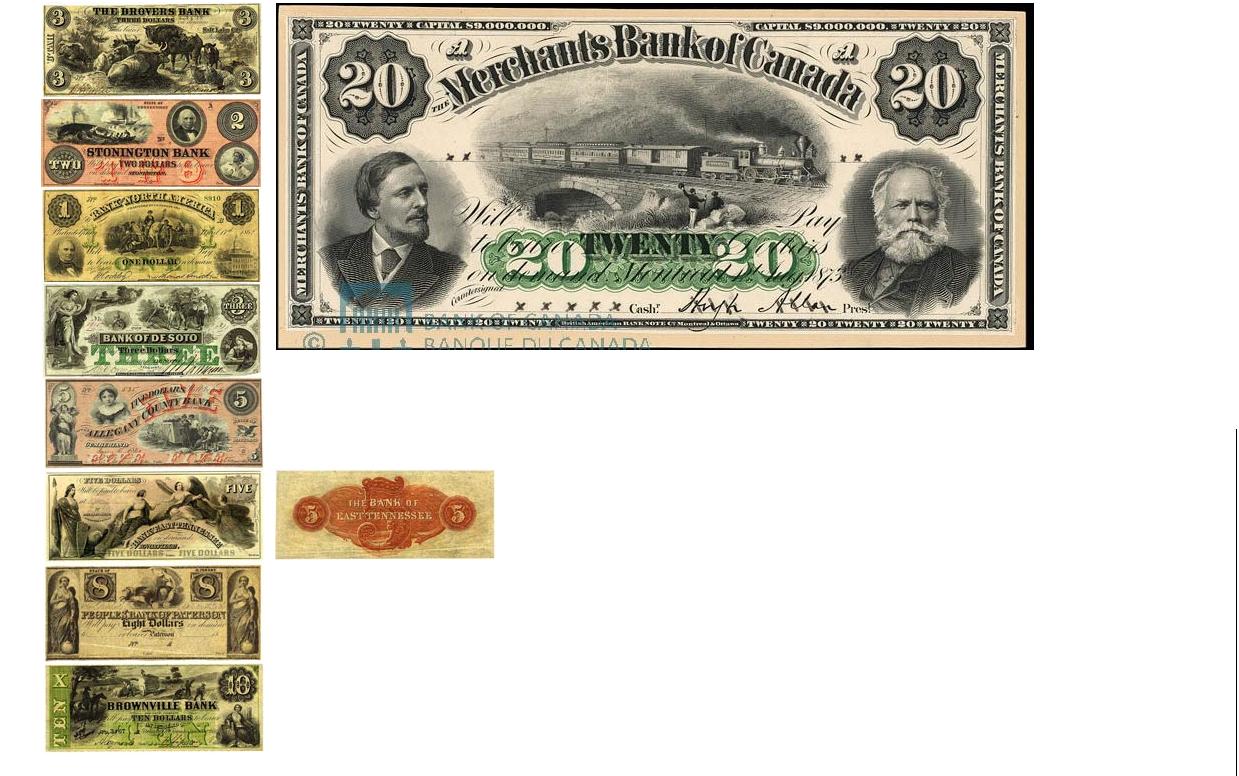

So, through time, these receipts began circulating and were known to be as “good as gold.” Eventually, these receipts began to look more and more like what paper currency looks like today. Here is a picture of some of these notes. The image below is not to scale, but if you click the picture it will take you to the properly scaled image:

Often times, banks would realize that there was little chance that all customers would demand their gold or silver at once. In these cases, banks would issue new currency that wasnt backed up and they would hope that people wouldnt redeem all of their notes at once. Although dishonest and fraudulent, this was generally not a big problem for the economy as a whole–people were usually smart enough to deposit their money in banks that had the reputation of maintaining 100% reserves.

However, the government (governments both inside and outside of the United States) responded to this banking system by doing what it does best–interfering in the arrangements of private individuals. Thus, governments often required that all banks redeem all bank notes, and not just their own notes. This created a “moral hazard” problem because banks essentially had no reason to maintain high reserves. When banks were not required to redeem the notes from other banks, they had an incentive to make sure that they kept high reserves (if they failed to do so, they would go out of business). But, when the government required them to accept all notes, they knew that they could issue as many notes as they wanted and that these notes would be redeemed by other banks throughout the country.

This situation was one of the main causes of several banking crises in the 1800’s, including the Panic of 1819. Furthermore, branch banking was prohibited which meant that banks had a tougher time dealing with the seasonal borrowing demands of their customers (ie, farmers might need to borrow more money during harvesting season and less after they have sold their crops).

And, while the “free banking period” has been described by many economists as the most stable period of banking in American history, what little instability that did exist was due to government intervention. The most important government interventions were the ones mentioned above–the requirement that banks accept the notes of all banks and the prohibition on branch banking.

The government was able to use these problems as a justification for moving the banking system in a new direction. Under this 2nd phase, the government prohibited banks from printing privately issued currency, but still allowed Americans to redeem their government issued bank notes for gold and silver.

This phase continued from the end of the Civil War through the early 1930’s, when President Roosevelt confiscated all gold and silver coins in the economy and changed the redemption rate of gold from around $20/oz to $35/an ounce (imagine losing 40% of the value of your money in one night).

During this third phase, money was still denominated in gold and silver, but could not be redeemed by American citizens. Only foreign citizens and governments could redeem money for gold or silver.

This phase continued for several decades until 1971, when President Nixon removed America from the gold standard completely. He was concerned with the rising costs of the Vietnam War and the entitlement programs of the Great Society, and became convinced that America’s economy would survive just fine off of a gold standard. Not coincidentally, his move was followed by over a decade of record (for America) inflation, double digit unemployment, high interest rates, and general economic decline. In this fourth phase, the American economy has been victim to a large number of economic booms, followed by economic busts, the national debt has soared, the value of the dollar has plumeted (the dollar has lost around 97% of its value, measured against gold since 1971).

To prevent massive rates of inflation and to restore order to the economy, the Federal Reserve must leave behind the policies that they have been following in recent decades. One important step that it can do to achieve this is to announce a schedule for increasing reserve requirements until banks reach a level of 100% reserves.

Why 100% reserves?

Think back to the history of the banking system described above. A bank deposit, whether redeemable for gold or cash is nothing more than an agreement between a bank and a person for the bank to hold some money now and return it later, on demand.

Thus, if I deposit $100 in a bank, the bank owes me $100. That $100 is my property and is only being held by the bank.

Because that $100 is still my property, the bank has no [moral] right to loan out my property to someone else. The Federal Reserve’s fractional reserve banking system exacerbates this problem because if I deposit $100 in a bank, they are only required to keep $10 on hand and can loan out the remaining $90 and thus create money out of thin air. I described this process in detail in my last article, but this can result in $100 turning into nearly $1000.

My bank receipt entitles me to withdraw the $100 that I deposited, but there are 9 other people who now have receipts entitling them to withdraw that same money. Thus is because there is now $100 in cash and $1000 in deposits. But this system is inherently immoral, after all, how can it be possible that 10 people own a legal title to the same property.

It is difficult to create an analogy that fits this situation because this practice itself seems like it just cannot be true. Imagine that you go out of town on a long vacation and drop your car off the airport’s long term parking lot. Pretend for the sake of this example that this lot is a valet lot and that you have handed the keys off to an attendant. The attendant realizes that you will not be back for several months and decides to rent the car out to a friend for the next month. This is immoral because the attendant has sold the rights to something that he does not own, but it is likely not to cause a problem as long as you dont come home early. But, suppose you do come home earlier than expected to deal with an unexpected problem. You will discover that the right to use your car is now being claimed by another person. This clearly creates a problem, afterall, two people cannot both fully own the same property.

Banks act in a similar manner, however, their game is much less honest and much more problematic. They essentially act as attendants who lend out your car to 9 other people (instead of just one) and hope that everyone’s schedules align just right so that no one will discover the fraud that has taken place. The creation of new money by banks leads to price inflation and bubbles in the economy at first, but always ends in an economic downturn and bank failures.

As economist Hans-Hermann Hoppe wrote: “Two individuals cannot be the exclusive owner of one and the same thing at the same time… This is an immutable principle; it is a law of action and nature that no contract can change or invalidate. Rather, any contractual agreement that involves presenting two different individuals as simultaneous owners of the same thing is.. objectively false and thus fradulent. Yet this is precisely what a fractional-reserve agreement between bank and customer involves.”

This system functions fine as long as Americans use debit cards rather than cash, but even a small increase in the demand for cash (as opposed to debit cards) can cause bank failures.

It is this artificial creation of money which causes temporary economic booms (whether it be in the form of a housing bubble, a dot com bubble, or something else), but these booms are inevitably followed by a bursting of the bubble and widespread economic chaos. This current economic crisis is the result of a rapid expansion of the money supply, low interest rates, and government intervention into the housing sector.

Requiring banks to maintain a 100% reserve requirement would tighten credit and would make it harder for banks to make poor investments. Thus, bubbles dont emerge and they dont burst. The economy functions much more smoothly and banks forced to respect the property rights of their customers.

However, banks cannot currently be required to hold 100% reserves without causing a lot of people to lose a lot of their hard earned money. But, this doesnt mean that we cannot begin the transition.

Currently, banks are “only” required to maintain a total of $67.041 billion. Because there are no reserve requirements for savings accounts and a 10% reserve requirement on checking deposits, this means that there is around $670.41 billion held in checking accounts. There is just over $1.05 trillion held by banks in “excess reserves,” meaning that there is a total of $1117.436 in reserves. Thus, it would be no problem for the Federal Reserve to require that banks hold 100% reserves for checking deposits. Banks would still hold around $400 billion in excess reserves and banks would no longer be able to create a situation where multiple people own titles to the same money.

But doing so could cause other problems. There would still be a disparity between required reserves for checking accounts and savings accounts. Banks could get around this problem by urging customers to move their checking deposits into savings accounts. So, any solution to this problem must require that checking accounts and savings accounts be subject to the same reserve requirements.

If we were to begin the process by requiring that banks hold 20% of both checking and savings deposits, the situation would be much better. There is currently $5.0455 trillion held in American savings accounts. Thus, a 20% requirement would mean that banks would need to hold $1.0091 trillion. If we add 20% of checking accounts [$134.082 billion], we are left with a requirement of $1,143,182,000,000 which puts us just under the amount of money actually held in reserves by American banks. If banks are given several weeks or even a month to meet these new requirements, they would easily be able to do so by restricting their lending.

In order to get to a 100% reserve requirement, it would actually be acceptable for the government/Federal Reserve to print additional money, as long as it did not expand the money supply beyond what was necessary to get to 100% reserves. The reason for this is that there is a great deal of money that is in the economy but that is not in print. Recall from above that a $100 deposit can easily become nearly $1000, but only $100 in cash actually exists. If we are to require 100% reserves and still prevent bank failures and people losing their deposits, it would be acceptable for the government to print the additional $900 created in the above example and send it to the banks. This would mean nothing more than the government printing money that was already in existence on the ledgers of banks, and will make the transition to 100% reserve banking much smoother and quicker.

Would a 100% reserve requirement stifle economic growth?

If banks are required to maintain 100% reserves, it is clear that they will loan out less money. While this is true, it does not mean that economic growth will be stifled.

Banks will still be able to make loans under a 100% reserve requirement. These loans would be made from funds deposited in CDs. CDs are a form of time deposit bank accounts in which a customer will deposit funds in an account for a specified time at a specified interest rate. For example, a customer might deposit $100 in 1 year CD at a 5% APR. During this period, the customer is not allowed to access their funds. After the year, the customer would receive $105 and they would be allowed to roll the funds over into another CD or withdraw their funds. The banks would be able to pay this sum by loaning that $100 out to a borrower at a rate higher than 5%.

Thus, banks would still be allowed to loan out funds and borrowers would still be able to receive loans to purchase houses, expand their businesses, or for any other purpose. Loans would be made without banks arbitrarily creating new money. Bank failures would no longer be a threat because banks would be required to maintain 100% reserves. Interest rates would adjust naturally and would reflect the market prices for agreements between bank customers, banks, and borrowers, with banks essentially serving as middlemen between lenders (depositors) and borrowers.

Sound Money

Maintaining a 100% reserve is a great first step, but it should not be seen as the last. The banking system must be integrated with the Federal Reserve’s supply of gold. This would return us to the days when money was actually money (a medium of exchange that had value to people) and not just numbers printed on paper. It would return us to a stable banking system and we would see the return of stable and slightly falling prices (which was the norm from 1800-1913).

The first thing that we need to do is figure out what the new total money supply would be if there were 100% reserves. If we add the $5.0455 trillion held in savings accounts and the $670.41 billion held in checking accounts, we come to the total of $5.71591 trillion.

The Federal Reserve currently holds 261.5 million oz of gold. Strangely, they value this gold at $42.22 per oz, even though the current market value of gold is around $1,200 per oz.

In order to readjust the value of gold relative to the dollar, we must divide the $5.71951 trillion by the 261.5 million oz of gold. After doing so, we find that gold would need to be pegged at the new price of $21,871.93 per oz (as of Monday, May 24, 2010).

This change in the price of gold would not cause problems in the economy or even cause a massive price inflation. It would essentially mean multiplying the price of everything the same number, meaning that all wages, prices, and costs would move together and would do so only one time. This is the case if and only if banks are required to maintain 100% reserves.

If we multiply everyone’s income, wealth, and the prices they pay for goods and services by 18, then no one is made any better or worse off by this intervention. But, what we have done is stabilize the banking system in order to ensure that everyone actually has a claim to their own funds. This would be far better than the current system, in which multiple people hold claims to the same money. It would also prevent the Federal Reserve and other banks from engaging in monetary inflation which can lead to price inflation, the boom and bust business cycle, and a destabilized economy.

Then What?

Following these measures, the Federal Reserve and its member banks must guarantee that customers may redeem their money for its equivalent value in gold. This move is common sense: if we are to return to sound money and to a gold standard, we must ensure that money is redeemable in gold. This would essentially make paper money equivalent to a ticket which can be exchanged for gold at any time.

After this is done, Congress, the Federal Reserve, and the Treasury Department must take the necessary steps to allow competing currencies. While gold has historically been the commodity chosen to serve as the medium of exchange, other metals including copper and silver have been used as well. The government must allow banks to issue their own currencies which can be denominated in which ever manner the issuing banks/mints choose.

It will be up to retail stores, businesses, and individuals to decide which currencies they will accept as payment for their services. The differences in currencies will undoubtedly be smoothed out by banks issuing debit cards which allow merchants to accept payments in the currency of their choice, despite the fact that the person paying for the services may be paying in a different currency. If this sounds unfeasible, think about what happens when you go out of the country and make purchases: you pay for goods in a foreign country using your debit or credit card, the foreign merchant gets paid in his local currency, you pay in American dollars, and the bank facilitates the transaction. The same process could occur at merchants within the United States with little difficulty.

The Federal Reserve and Congress have the ability to stop hyperinflation, further banking failures, the business cycle, and other economic disruptions. However, their ability to do so depends on the implementation of the above policies. We must return to a situation where each dollar was only owned by one person. It is just not feasible to have a situation where two individuals have the same legal claim to ownership over the same property. We must return to sound money, backed by a commodity which itself is valued by individuals. We must end the legal monopoly status of Federal Reserve notes and allow individuals to accept payments and pay for goods and services with the currency of their choice. Failure to do so could have consequences dire enough to make the current economic crisis look like a drop in the bucket.

Americanly Yours,

Phred Barnet

Please help me promote my site:

Share on Facebook

Become a fan on Facebook