Borrowing

A few weeks back, several of my friends and I exchanged arguments over email. I wanted to pull a quote from a response of one of my friends and use it to talk about interest rates.

“. . . TBILLS at the lowest rates ever! We can print money for nearly no intrest [sic]. . .”

I think that this is a common misconception among people. Yes, the FED has a target rate of 0-1/4% for the Federal Funds Rate, but this rate is only the rate that banks charge each other for overnight loans. This is not the rate for US Government bonds which are issued to fund government debt. In fact, US government bonds have a much higher interest rate than the overnight fed funds rate. Government bonds are largely traded on the open market which means that they are priced through supply and demand. The current rate on a 10 year bond (about 3%) can be found here.

We have a large national debt that is growing every day. Of the money that we owe, our debt to China is over $1,000,000,000,000 [$1 trillion]. To continue to fund ambitious “stimulus” bills, government bailouts, and large social welfare programs like medicare and the coming socialized health care scheme, we will have to continue to borrow funds from American citizens and foreign nations.

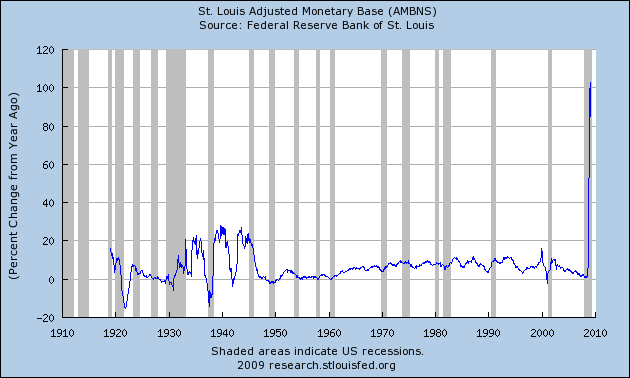

As we increase our money supply, our money becomes worth less. As we increase our borrowing, we have to pay higher interest rates in order to entice countries and private citizens to loan money to us. Both of these things are happening at the same time, and happening during a global recession. This leads me to believe that interest rates on government bonds will be rising (if no one wants to loan us money and we want to keep running a deficit, we have to raise interest rates).

We have more than doubled our money supply in the last year! If you dont believe me, see the chart below, or click here.

But, things dont end there. China’s Premier, Wen Jiabao recently expressed worry about the value of the dollar. He said “Of course we are concerned about the safety of our assets. To be honest, I’m a little bit worried.” Apparently, there is even debate within China about whether or not to continue to invest so heavily in American bonds. And of course, this is coming at a time when China is dealing with their own economic problems. China needs to have high levels of annual economic growth in order to pacify their increasingly restless (and violent) rural populations.

China just announced a stimulus of their own totaling over $500 billion. The money being spent on that stimulus is money that cannot be loaned to the American government.

One thing that very few people are aware of is that President Obama’s anticipated budgets for his 8 years as president (assuming that he wins a second term) have the national debt doubling to over $20,000,000,000,000 [$20 trillion]! In order to finance these massive budget deficits, we have to borrow this money from someone. If China turns off the loans, it is going to be very hard to find the money to continue to fund massive national programs, while fighting two wars and bailing out American industries. China has us right where they want us… and they know it.

Americanly Yours,

Phred Barnet

Please help me promote my site: