The Time Has Come: End The War In Afghanistan

The War in Afghanistan will soon have been going on for 8 years with absolutely no end in sight.

Are we losing? Maybe, maybe not. But, it is clear that we are not winning.

A “surge” like President Bush’s successful strategy for turning around the Iraq War is unlikely to work in Afghanistan.

This War has cost hundreds of billions of dollars in Treasure and, more importantly, hundreds of honorable American lives.

I supported this War for a long time–pretty much everyone did at some point. In November 2001, shortly after the War started, only 9% of Americans thought the War was a mistake.

But, changing situations create the need for changes in outlook, and often changes in policy.

Whether or not the War was a mistake, a majority of Americans now want our troops to leave Afghanistan.

We have not succeeded in dismantling al-Qaeda. We have not captured Osama bin-Laden or many of the other high value targets.

The Soviet Empire’s premature end was due in part to its war in Afghanistan. We should not allow history to repeat itself and bring an end to the mighty American Empire as well.

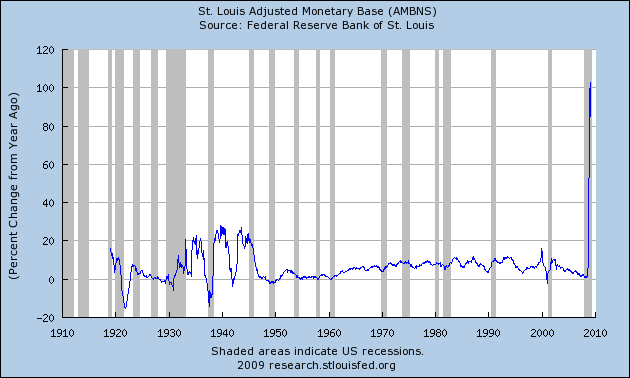

This Nation is hemmorhaging money, the economy is dismal. It is time to stop spending so much of our National fortune on this War. Our cost for this War will be paid back over the next 3o years to China and others who have loaned us the money to fight.

Afghanistan’s government is crumbling and it now appears that Hamid Karzai, Afghanistan’s American backed Prime Minister may have engaged in ballot-stuffing and other measures of voter fraud to keep himself in power. These actions are preciously the same that American officials have criticized Iran for taking. By standing behind a government like this, we are implicitly voicing our approval of these actions.

This war has spilled over into Pakistan and has greatly destabilized a nation with nuclear weapons–threatening the security of the entire world in the process.

The anti-war left has recently been strangely silent over the wars in Afghanistan and Iraq. My assumption is that they have not wanted to create political problems for a President that they largely supported while he is trying to push through health care and environmental legislation also largely supported by this group. With the health care and cap and trade bills headed for near-certain failure or at a least a major watering down, I suspect that the anti-war left will begin to be more vocal in its opposition to the War in Afghanistan again soon.

New polls show that the majority of Americans now oppose the War in Afghanistan. President Obama’s approval ratings have now dropped to the mid-40-low 50’s range. You can be certain that President Obama does not intend to sacrifice his popularity over a war that was started on President Bush’s watch.

In the coming months, President Obama soon announce his decisions on what to do about the War in Afghanistan. Many policy analysts believe that the President will announce a large increase in the number of troops for Afghanistan. This is exactly the wrong strategy. President Obama should begin a massive withdrawal of American troops from Afghanistan. Im not saying that we shouldnt continue to hunt bin-Laden–I would favor leaving behind an extremely small and elite force to hunt terrorists and bring them to justice. However, we should stop engaging in “nation building,” stop propping up Karzai’s corrput government, and stop fighting this War. If other Nations wish to continue fighting this War without our aid, let them do so, but the United States government should cease spending the lives and the wealth of Americans on this War.

We can still leave Afghanistan honorably; it is time to do the right thing and bring our brave and heroic men and women home from Afghanistan.

Americanly Yours,

Phred Barnet

Please help me promote my site: